Sponsorship Opportunities

Sponsorship Opportunities

Sponsor the leading FX event

Re-connect and forge new relationships with the leaders of FX trading

FX Markets USA returns to New York for 2024, gathering an unrivalled audience of senior FX traders from asset management firms, investment banks, corporates, exchanges, hedge funds, insurance firms, pension funds and prime brokers.

Our conference gives you the opportunity to showcase your brand, meet, network, build relationships and make an impact on potential customers as they seek to enhance their trading process and reduce risk.

Download the sponsorship pack View the delegate snapshot

Why sponsor?

-

Position your organisation as a revolutionary thinker

-

Reach senior decision-makers looking for answers

-

Access the network of FX Markets subscribers, and its sister brand Risk.net, before, during and after the event

-

Benefit from FX Markets' experience in delivering thought leadership and senior audiences to our event sponsors for more than 25 years

2023 agenda topics

-

Electronification: transparency and algos

-

Large language models, NLP, ML and other AI

-

Priorities for LATAM trading

-

FX settlement challenges

-

Liquidity and execution

-

Technology and NDFs

-

Crypto, stablecoins and blockchain

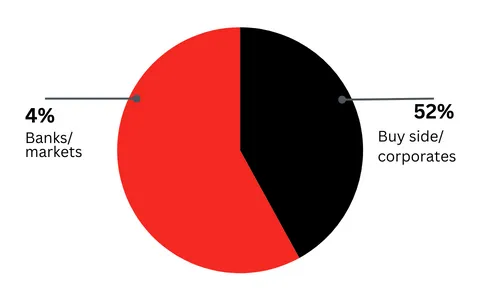

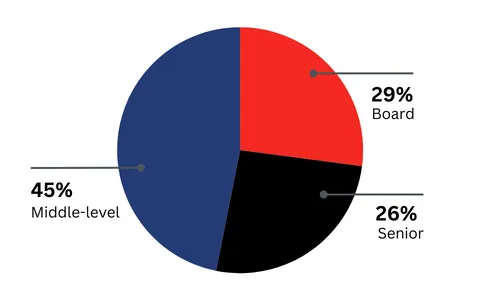

Our audience

Industry breakdown

Seniority breakdown

Our attendees

About Macquarie Group

Macquarie Group Limited (Macquarie) is a diversified financial group providing clients with asset management and finance, banking, advisory and risk and capital solutions across debt, equity and commodities. Founded in 1969, Macquarie employs 15,704 people in 31 markets. At 30 September 2019, Macquarie had assets under management of £309.2 billion. For further information, visit www.macquarie.com

Societe Generale

Societe Generale is one of the leading European financial services groups. Based on a diversified and integrated banking model, the Group combines financial strength and proven expertise in innovation with a strategy of sustainable growth, aiming to be the trusted partner for its clients, committed to the positive transformations of society and the economy.

Active in the real economy for over 150 years, with a solid position in Europe and connected to the rest of the world, Societe Generale has over 147,000 members of staff in 67 countries and supports on a daily basis 31 million individual clients, businesses and institutional investors around the world by offering a wide range of advisory services and tailored financial solutions. The Group is built on three complementary core businesses:

- French Retail Banking, which encompasses the Societe Generale, Crédit du Nord and Boursorama brands. Each offers a full range of financial services with omnichannel products at the cutting edge of digital innovation;

- International Retail Banking, Insurance and Financial Services to Corporates, with networks in Africa, Russia, Central and Eastern Europe and specialised businesses that are leaders in their markets;

- Global Banking and Investor Solutions, which offers recognised expertise, key international locations and integrated solutions.

Societe Generale is included in the principal socially responsible investment indices: DJSI (World and Europe), FTSE4Good (Global and Europe), Euronext Vigeo (World, Europe and Eurozone), four of the STOXX ESG Leaders indices, and the MSCI Low Carbon Leaders Index.

For more information, you can follow us on twitter @societegenerale or visit our website www.societegenerale.com

HSBC is a financial services organisation that serves more than 40 million customers, ranging from individual savers and investors to some of the world’s biggest companies and governments. Its network covers 64 countries and territories, and its expertise, capabilities, breadth and perspectives open up a world of opportunity for its customers. HSBC is listed on the London, Hong Kong, New York, Paris and Bermuda stock exchanges.

Founded in 1869, Goldman Sachs is a leading global investment banking, securities and investment management firm. Headquartered in New York, it maintains offices in all major financial centres worldwide.

2023 sponsors

Panel Sponsor

26 Degrees Global Markets is an award-winning multi-asset Prime Broker specialising in providing prime services to broker dealers, hedge funds, proprietary trading firms and family offices globally.

With over a decade of proven history in Australia under former brand Invast Global, 26 Degrees is continuing to revolutionise the prime brokerage space by providing bespoke and innovative solutions to their clients internationally and responding quickly to the constantly evolving institutional client needs. Their direct relationships with a variety of Tier 1 Prime Brokers allows them to provide a robust clearing facility alongside exceptional liquidity, sourced from an aggregation and careful curation of the leading bank and non-bank liquidity providers across the globe.

Associate Sponsor

oneZero Financial Systems has been a leading innovator in multi-asset class enterprise trading technology for over a decade. Its powerful software encompasses the Hub, EcoSystem and Data Source - three components that separately solve specific organizational challenges and together provide a complete solution for trading technology, distribution and analytics. Through reliable connectivity, technology, infrastructure and market access, oneZero empowers financial institutions and brokers to compete effectively in the global financial markets through a globally compliant, liquidity-neutral solution.

Transparent, precise, consistent execution

LMAX Exchange, part of the LMAX Group, delivers efficient market structure and transparent, precise, consistent execution to all market participants, including funds, banks, proprietary trading firms, brokerages and asset managers.

Operating multiple global institutional FX exchanges and an FCA regulated MTF, LMAX Exchange enables institutions to trade on a central limit order book with streaming firm limit order liquidity from top tier global banks and non-banks.

ION Commodities

ION Commodities is the leading provider of commodity management solutions (CMS) to organizations of all sizes. ION Commodities offers a comprehensive portfolio of innovative solutions that empower businesses operating in energy, commodity, and environmental certificate markets to adapt, grow, and unlock their full potential.

At ION, we go beyond traditional CTRM and ETRM solutions. We digitalize the complete contract lifecycle addressing the entire value chain from trading and risk management to refining, processing, storage, logistics, distribution and compliance. With ION solutions, you can buy, sell, hedge, trade, forecast, produce, refine, blend, schedule, move, store, invoice, settle and report – All in one place.

ION's portfolio includes a suite of best-in-class CTRM and ETRM solutions such as Agtech, Allegro, Aspect, Carbon Zero, TriplePoint, RightAngle, and Openlink. For value-added benefits, these solutions can be combined with ION’s complementary solutions: FEA (advanced trading and risk analytics), Softmar (vessel chartering), and WAM (supply chain optimization).

smartTrade Technologies is a leading global provider of multi-asset electronic trading platforms, helping customers achieve business growth through its cost-efficient and technologically advanced secure private software-as-a-service end-to-end solution.

As the world's leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world's leading central counterparty clearing providers, CME Clearing.

Interested in sponsoring? Contact us today

Sponsorship enquiries

Antony Chambers

Publisher, Risk.net/FX Markets/WatersTechnology