FX Markets Events

FX Markets events are where the buy-side and sell-side community comes together from across the globe to learn, debate and network.

Connect and forge new relationships with FX markets traders and industry peers

FX-Markets.com delivers exclusive news from journalists writing on three continents. With access to senior figures in the global FX market, we cover key trading, regulation, infrastructure, technology and data stories. Our award-winning events range from intimate roundtable discussions, briefings to full-scale exhibitions.

Conferences

Webinars

Curated by the FX Markets editorial team, the webinar series will consist of five interactive panel discussions. Each session will deliver current and forward-looking insights and innovative solutions for the FX community during this time of global uncertainty and digital transformation.

Five insightful webinars, covering key topics:

Slashing settlement

April 24

Explore the impact of the transition to T+1 settlement in the US securities market on currency traders, particularly in Europe and Asia and discover how firms are adapting to these challenges and the role settlement services can play in facilitating smoother operations amidst this shift.

Primary colours

May 22

Discover expert predictions on the evolving dynamics of the spot FX market, exploring the shift away from traditional primary venues to futures markets as alternative touchstones.

FX automation: mission incomplete?

June 11

Delve into the evolution of trading desks in the FX market. Explore the challenges and opportunities arising from the shift towards automation, and discover strategies for liquidity providers to adapt to the changing landscape. Discover insights into the steps leading firms are taking to automate end-to-end processes and enhance efficiency in FX trading workflows.

Putting the ‘currency’ in ‘crypto-currency’

September 11

This FX Markets webinar will delve into the evolving similarities and disparities between traditional currency markets and the emerging world of cryptocurrencies, and will explore the distinctions shaping the future market structure of currency trading in both realms.

Where platforms go next

November 28

Delve into the evolving FX trading landscape and explore the popularity of single- versus multi-dealer venues, the impact of liquidity aggregators and execution management systems, and the which trading protocols and ancillary services will take off?

Awards

Be noticed alongside leaders in the FX markets industry by sponsoring our trusted annual awards. FX Markets recognises excellence during its annual awards series.

Companies that have attended our conferences

Every day brings a new set of investment challenges and opportunities. Through our unique combination of expertise, research and global reach, we work tirelessly to anticipate and advance what’s next—applying collective insights to help keep our clients at the forefront of change.

Stand number: 54, 59

AXA XL, the P&C and specialty risk division of AXA, is known for solving complex risks. For mid-sized companies, multinationals and even some inspirational individuals we don’t just provide re/insurance, we reinvent it. How? By combining a strong and efficient capital platform, data-driven insights, leading technology, and the best talent in an agile and inclusive workspace, empowered to deliver top client service across all our lines of business − property, casualty, professional, financial lines and specialty. With an innovative and flexible approach to risk solutions, we partner with those who move the world forward.

To learn more, visit axaxl.com

BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries.

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 74 countries, with more than 192,000 employees, including more than 146,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients to realise their projects through solutions spanning financing, investment, savings and protection insurance.

Fully integrated in the BNP Paribas Group, BNP Paribas Corporate and Institutional Banking (CIB) is a leading provider of solutions to two client franchises: corporates and institutionals, and operates across EMEA, APAC and the Americas. The bank is a global leader in Debt Capital Markets and Derivatives. It is a top European house in Equity Capital Markets and it has leading franchises in Specialised Financing. In Securities Services, it is a top five house worldwide.

BBH is a privately held financial institution that has been a thought leader and solutions provider for 200 years. The Firm serves businesses, institutions, individuals and families in its three business lines: Investor Services, Investment Management, and Private Banking. BBH's Investor Services business provides cross-border custody, accounting, administration, execution and technology services to many of the world's leading asset managers and financial institutions.

BBH operates in eighteen locations, including New York, Boston, Beijing, Charlotte, Chicago, Denver, Dublin, Grand Cayman, Hong Kong, Kraków, London, Luxembourg, Nashville, New Jersey, Philadelphia, Tokyo, Wilmington, and Zürich.

BBH Hong Kong has been servicing Hong Kong based clients for nearly over 30 years. As a cross-border specialist with a strong focus on Greater China, BBH is a market leader in helping global asset managers access the region's growing capital pools, and Greater China managers looking to distribute their products globally.

BBH is an ETF specialist for US, European and Asian Domiciled products, and works with both experienced ETF managers and new, innovative market entrants to introduce and grow their ETF products.

For more information, please visit www.bbh.com.

BBH 是一家私人持有的金融機構, 200年來一直是創意及提供解決方案的領導者。本行於三個業務領域: 投資者服務、投資管理和私人銀行,為企業機構, 個人和家庭提供服務。BBH 的投資者服務業務為許多世界領先的資產管理公司和金融機構提供跨境託管、會計、管理、執行和技術服務。

BBH 在紐約、波士頓、北京、夏洛特、芝加哥、丹佛、都柏林、大開曼群島、香港、克拉科夫、倫敦、盧森堡、納什維爾、新澤西、費城、東京、威爾明頓和蘇黎世等18個地點開展業務。

BBH 香港以香港為基地的客戶提供服務已近30多年。作為專注於大中華區的跨境基金專家BBH在協助 環球資產管理公司進入該地區持續增長的資本池 及大中華區資產管理公司在全球分銷其產品一直處於市場領先地位。

BBH 是美國、歐洲和亞洲國內產品的 ETF 產品專家, 與經驗豐富的 ETF 經理和新的、創新的市場進入者合作, 介紹和發展他們的 ETF 產品。

欲瞭解更多資訊, 請訪問 www.bbh.com。

BBH(브라운 브라더즈 해리먼: Brown Brothers Harriman)는 민간 금융기관으로서 지난 200년 동안 꾸준히 선구자로서 솔루션을 제공해왔다. 주 업무는 투자자 서비스, 투자 관리 및 프라이빗 뱅킹 등 3가지 분야로 나눌 수 있으며 BBH의 투자자 서비스 부문은 국내외를 연계한 자산보관 관리, 회계, 유지관리 및 집행 서비스를 포함하고 있으며 세계 유수의 많은 자산 운용사와 금융기관을 대상으로 하고 있다.

BBH는 뉴욕, 보스톤, 베이징, 샤롯, 시카도, 덴버, 더블린, 그랜드 케이만, 홍콩, 크라코우, 런던, 룩셈부르그, 내쉬빌, 뉴저지, 필라델피아, 도쿄, 윌밍턴 및 취리히등 18개 지역에서 업무를 진행하고 있다. 보다 상세한 정보는 bbh.com웹사이트에서 확인 가능하다.

BBH 홍콩은 30년에 걸쳐 홍콩에 기반을 둔 클라이언트에게 서비스를 제공해왔으며 중국에 역점을 둔 해외 전문가로서 글로벌 자산 관리자들이 이 지역의 점증하는 자본에 좀더 쉽게 접근하도록 지원하는 동시에 중국의 자산 관리자들의 자사 금융상품 글로벌 시장 진출 업무도 지원해 주고 있다.

BBH는 미국, 유럽 및 아시아의 수감 제품에 대 한 ETF 전문가 이며, 경험 많은 ETF 관리자와 새롭고 혁신적인 시장 참가자 들이 ETF 제품을 소개 하 고 성장 시키기 위해 협력 하고 있다.

보다 상세한 정보는 www.bbh.com에서 확인 가능하다

BBHは、200年にわたり、ソートリーダー(”Thought Leader”)として、またソリューションプロバイダー(”Solution Provider”)として業界をリードしてきた独立系金融機関です。インベスター・サービス、インベストメント・マネージメント、プライベート・バンキングからなる3つの事業を展開しており、機関投資家やファミリーオフィス、個人のお客様へサービスを提供しています。

インベスター・サービス事業では、グローバルに展開する運用会社や金融機関のお客様へ、クロスボーダー・カストディ、ファンド計理・管理、テクノロジー・サービス等を提供しています。また、BBHは、世界の金融都市を含む18か所に拠点を有しています(ニューヨーク、ボストン、北京、シャーロット、シカゴ、デンバー、ダブリン、グランドケイマン、香港、クラクフ、ロンドン、ルクセンブルク、東京、ウィルミントン、チューリッヒ等)。※詳細はウェブサイトbbh.com をご確認ください。

BBH香港拠点は30年以上にわたり、香港をベースとするお客様にサービスを提供しています。グレーター・チャイナ・ビジネスに強みを持つ、クロスボーダー・サービスのスペシャリストとしてBBHは、成長著しい中国市場のキャピタルを狙う運用会社や、グローバル展開を目指す中国の運用会社をサポートしてきました。

BBHは、米国、欧州、アジアにおけるETFプロダクトのスペシャリストとして、ETF大手の運用会社や、市場へ新規参入を試みる革新的な運用会社の成長をサポートします。

詳細は、ウェブサイトをご確認ください。 www.bbh.com

Markets don’t stand still. To succeed, our clients must navigate the changing FX marketplace with efficiency. They need a partner they can trust.

No one has contributed more to the growth of this market than CLS. We’re proud to be the world’s leading provider of FX settlement services. Our innovative thinking has transformed FX by reducing risk and, since our launch in 2002, we’ve created significant efficiencies and cost-savings for our clients. We’ve earned the trust of our members - over 70 of the world’s most important financial institutions. With more than 25,000 third-party clients using our services we settle USD5 trillion of payment instructions on an average day.

Today we leverage our experience and substantial market intelligence to address our clients’ wider settlement, processing and data needs. Our experts collaborate with our partners across the FX market, leading the development of rigorous standardized solutions in response to real market problems. CLS’s forward-looking products make the trading process faster, easier, safer and more cost-effective – empowering our clients’ success.

Credit Suisse AG is one of the world's leading financial services providers and is part of the Credit Suisse group of companies. As an integrated bank, Credit Suisse is able to offer clients its expertise in the areas of private banking, investment banking and asset management from a single source. Credit Suisse provides specialist advisory services, comprehensive solutions and innovative products to companies, institutional clients and high net worth private clients worldwide, and also to retail clients in Switzerland. Credit Suisse is headquartered in Zurich and operates in over 50 countries worldwide. The registered shares (CSGN) of Credit Suisse's parent company, Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York.

Further information about Credit Suisse can be found at www.credit-suisse.com

Founded in 1869, Goldman Sachs is a leading global investment banking, securities and investment management firm. Headquartered in New York, it maintains offices in all major financial centres worldwide.

Invesco is an independent investment management firm that helps clients build long-term, strategic partnerships with official institutions, offering the best of its investment expertise and capabilities.

It manages $1.4 trillion in assets on behalf of clients worldwide and offers specialised investment teams across a comprehensive range of asset classes, investment styles and geographies.

Invesco has more than 8,400 employees worldwide and an on-the-ground presence in more than 20 countries, serving clients in more than 120 countries.

LCH ForexClear, a leading provider of foreign exchange (FX) derivatives clearing, delivers unmatched capital and operational efficiencies. Built in partnership with the market and with the benefit of LCH’s extensive experience in interest rate swaps clearing, ForexClear’s 24-hour FX clearing service offers industry-leading risk management for deliverable FX forwards, spot and options, non-deliverable forwards and non-deliverable options, across multiple emerging market and G10 currency pairs. LCH is an LSEG business.

Macquarie Group Limited (Macquarie) is a global financial services group providing clients with asset management, retail and business banking, wealth management, leasing and asset financing, market access, commodity trading, renewables development, specialist advice and access to capital and principal investment. Founded in 1969, Macquarie employs over 20,600 people in 34 markets. At 31 March 2024, Macquarie had assets under management of £484.8 billion. For further information, visit www.macquarie.com

About Nikko Asset Management

With US$214 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

Headquartered in Asia since 1959, the firm represents nearly 200** investment professionals and over 30 nationalities across 11 countries. More than 300 banks, brokers, financial advisors and life insurance companies around the world distribute the company’s products.

The investment teams benefit from a unique global perspective complemented by the firm's historic Asian DNA, striving to deliver consistent excellence in performance. The firm also prides itself on its progressive solution-driven approach, which has led to many innovative funds launched for its clients.

* Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 March 2019.

** As of 31 March 2019, including employees of Nikko Asset Management and its subsidiaries.

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider of wealth management, asset servicing, asset management and banking to corporations, institutions, affluent families and individuals. Founded in Chicago in 1889, Northern Trust has offices in the United States in 19 states and Washington, D.C., and 23 international locations in Canada, Europe, the Middle East and the Asia-Pacific region. As of September 30, 2018, Northern Trust had assets under custody/administration of US$10.8 trillion, and assets under management of US$1.1 trillion. For more than 125 years, Northern Trust has earned distinction as an industry leader for exceptional service, financial expertise, integrity and innovation. Visit northerntrust.com or follow us on Twitter @NorthernTrust.

Northern Trust Corporation, Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A., incorporated with limited liability in the U.S. Global legal and regulatory information can be found at https://www.northerntrust.com/disclosures.

Societe Generale is one of the leading European financial services groups. Based on a diversified and integrated banking model, the Group combines financial strength and proven expertise in innovation with a strategy of sustainable growth, aiming to be the trusted partner for its clients, committed to the positive transformations of society and the economy.

Active in the real economy for over 150 years, with a solid position in Europe and connected to the rest of the world, Societe Generale has over 149,000 members of staff in 67 countries and supports on a daily basis 31 million individual clients, businesses and institutional investors around the world by offering a wide range of advisory services and tailored financial solutions. The Group is built on three complementary core businesses:

- French Retail Banking, which encompasses the Societe Generale, Crédit du Nord and Boursorama brands. Each offers a full range of financial services with omnichannel products at the cutting edge of digital innovation;

- International Retail Banking, Insurance and Financial Services to Corporates, with networks in Africa, Russia, Central and Eastern Europe and specialised businesses that are leaders in their markets;

- Global Banking and Investor Solutions, which offers recognised expertise, key international locations and integrated solutions.

Societe Generale is included in the principal socially responsible investment indices: DJSI (World and Europe), FTSE4Good (Global and Europe), Euronext Vigeo (World, Europe and Eurozone), four of the STOXX ESG Leaders indices, and the MSCI Low Carbon Leaders Index.

Thomson Reuters is the world’s leading source of news and information for professional markets. Our customers rely on us to deliver the intelligence, technology and expertise they need to find trusted answers. The business has operated in more than 100 countries for more than 100 years. Thomson Reuters shares are listed on the Toronto and New York Stock Exchanges. For more information, visit www.thomsonreuters.com.

Tracing our history to 1928, Wellington Management is one of the world’s largest independent investment management firms. With over US$1.3 trillion in assets under management as of 31 March 2022, we serve as a trusted investment adviser to more than 2,400 institutional clients and mutual fund sponsors in over 60 countries. Our comprehensive investment capabilities are built on the strength of rigorous, proprietary research and span nearly all segments of the global capital markets, including equity, fixed income, multi-asset, and alternatives. Our commitment to investment excellence is evidenced by our significant presence and long-term track records in nearly all global securities markets.

Our audience

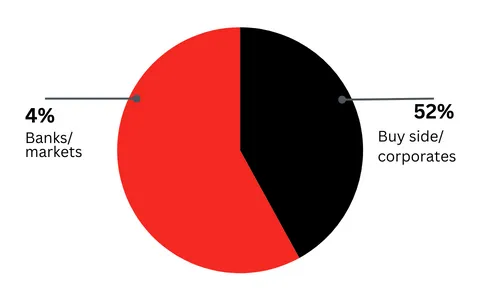

Industry breakdown

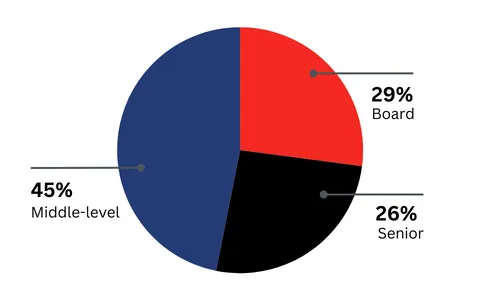

Seniority breakdown

Why partner with FX Markets

Share your expertise

Engage with and make an impact on potential customers through a speaking slot or panel participation.

Generate leads and drive business growth

Receive delegate contact details to sustain business relationships post-webinar.

Year-round promotion

Reach an even larger audience through a presence on our FX Markets event websites, social media channels and marketing campaigns.

What delegates said about FX Markets events

An important conference for currency specialists - a must attend event

Managing Director, Global Liquid Strategies, QIC

Very good quality speakers

Associate Director, Financial Institution and Government, Mizuho Bank, Ltd

Very intellectual and informative speaker from a wide range of industries which was beneficial as it provided the audience with a broad exposure of information.

Financer Manager, Qantas Airways Limited

Professional, in touch with the market and its participants and keen to promote integrity and best practice as a value proposition for the benefit of the entire industry.

Head of Compliance, FX and Rates, ANZ Bank

This was an informative and relevant conference, with high quality industry - leading speakers that was well attended and ran smoothly.

Executive Director, Institutional FX Sales, Common Wealth Bank of Australia

Keynote speaker attracted crowd and focused on key market trend.

Head of Corporate Audit Australia, Bank of America Merrill Lynch

Well run and informative

Head Corporate Treasury & Risk, Australian Broadcasting Corporation

I found all the presentations of interest. I was pleased with the different streams in the afternoon. this really helped me to attend the more relevant sessions

Rob Wensak, Director, Treasury Trading, WESTERN UNION

A very well balanced show and liked the introduction of more buy-side participants this year

Mark Davison, Managing Partner, CORONAM EC LTD

High quality participants, very interesting topics being debated - top event

Thomas Morten Jensen, Senior Analyst, NORDEA

A valuable opportunity to tap into the cutting-edge developments in the FX industry and network with industry leaders

Justin Gillespie, FX Fund Manager, ESSEMTIUM CAPITAL

Excellent event. Very interesting speakers and material presented. Highly enjoyable, met some great people and it was very professionally run

Saul Zaidman, Portfolio Manager, VIVA GLOBAL

I was impressed with the quality of the content, the high level of the attendees and the interactive networking opportunities

Stephane Malrait, Global Head of eCommerce and Innovation for Financial Markets, ING FINANCIAL MARKETS

Get in touch:

For more information on how you can get involved in the FX events, contact:

Sponsorship enquiries

Antony Chambers

Publisher, Risk.net/FX Markets/WatersTechnology